Transactions

$7.2 Million

Multifamily

Dallas, TX

BSP provided an $7.2MM CMBS fixed-rate loan on a 79-unit, 96.2% occupied multifamily property located in Dallas, TX. The loan was used to pay off existing debt, pay associated closing costs and return equity to the sponsor.

$120.0 Million

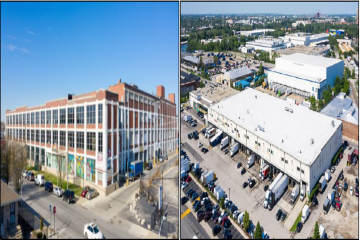

Office

Retail

Industrial

Dallas, Houston, San Antonio TX

BSP provided a $120MM floating-rate loan on a 4,2MM SF portfolio comprised of 27 office, industrial and retail properties located throughout Dallas, Houston and San Antonio, TX. The loan will facilitate the borrower’s exit out of bankruptcy and bridge them through the sale of their legacy real estate portfolio.

$53.1 Million

Industrial

Hardeeville, SC

BSP provided a $53.1MM floating-rate loan on a to-be-constructed, 642K SF, Class A warehouse/distribution complex located in Hardeeville, SC. The loan will be used to facilitate the construction of the Property, fund reserves, and pay closing costs.

$46.3 Million

Industrial

Hemet, CA

BSP provided a $46.3MM fixed-rate loan on a to-be-constructed, 850,640 SF single-tenant, distribution warehouse located in Hemet, CA. The loan was used to acquire the land, fund construction costs, fund reserves, and pay closing costs.

$29.5 Million

Multifamily

Fort Worth, TX

BSP provided a $29.5MM floating-rate loan on a 323-unit multifamily asset located in Fort Worth, TX. Loan proceeds were used to acquire the property, fund future capital expenditures at the property and pay closing costs.

$75 Million

Industrial

NC

BSP provided a $75.00MM floating-rate loan on a nine-property, 100% occupied industrial portfolio in various locations in North Carolina. The loan was used to acquire the property, fund reserves, and pay closing costs.

$4.9 Million

Retail

Chelsea, MI

BSP provided a $4.9MM fixed-rate loan on a single-tenant retail asset located in Chelsea, MI. Loan proceeds were used to pay off the Borrower’s existing debt, fund repairs, pay closing costs and return equity to the Borrower.

$36.4 Million

Multifamily

San Antonio, TX

BSP provided a $36.4MM fixed-rate bridge loan on a 352-unit, garden-style community apartment complex located in San Antonio, Texas. The loan was used to acquire the property.

$78.2 Million

Multifamily

Round Rock, TX

BSP provided a $78.2MM floating-rate loan on a 777-unit apartment complex portfolio comprised of two garden-style multifamily assets located in Round Rock, Texas. The loan was used to retire the existing loan, fund future renovations, purchase a rate cap, and pay closing costs.

$6.0 Million

Retail

Oxon Hill, MD

BSP provided a $6.0MM fixed-rate loan on a 73,531 SF Sunrise Shopping Center located in Oxon Hill, MD. The loan was used to pay off the existing loan, fund escrows, and pay associated closing fees.

$50.75 Million

Multifamily

Orlando, FL

BSP provided a $50.75MM floating-rate loan on a 320-unit multifamily asset located in Orlando, FL. The loan was used to retire the existing debt, pay closing costs, purchase an interest rate cap and fund an interest reserve.

$62.5 Million

Hospitality

Denver, CO

BSP provided a $62.5MM floating-rate loan for a 243-key full-service hotel and a 231-key limited Service hotel located in Denver, CO. The loan was used to refinance existing debt and pay closing costs.

$23.0 Million

Industrial

Carson, VA

BSP provided a $23MM fixed-rate loan on a refrigerated/cold storage facility located in Carson, CA. The loan was used to pay off existing debt to the property, pay closing costs and return equity to the Sponsor.

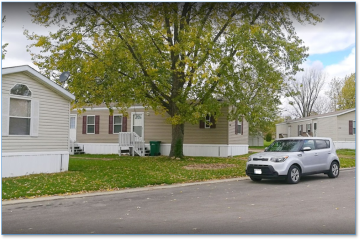

$18.1 Million

Multifamily

La Verne, CA

BSP provided a $18.1MM fixed-rate loan on a 286-unit, manufactured housing property located in La Verne, CA. The loan was used to pay off existing debt to the Property and to pay closing costs.

$13.7 Million

Multifamily

Greenburg, IN

BSP provided a $13.7MM fixed-rate loan on a 259-unit, multifamily portfolio located in Greensburg, IN. The loan was used to refinance the existing mortgage and to pay closing costs.

$9.25 Million

Industrial

Rochester Hills, MI

BSP provided a $9.25MM fixed-rate loan on a 100,000 SF, 100% occupied, 2017-vintage, industrial building located in Rochester Hills, MI. The loan was used to acquire the Property, fund reserves, and pay closing costs.

$28.5 Million

Multifamily

Reno, NV

BSP provided a $28.5MM floating-rate loan on a 214-key, full-service 1957/2017 vintage hospitality asset located in Reno, NV. The loan was used to refinance the asset, fund a PIP, and pay closing costs.

$22.5 Million

Multifamily

Denton, TX

BSP provided a $22.5MM floating-rate loan on a 149-unit, garden-style multifamily asset located in Denton, TX. The loan was used to retire the existing loan, pay closing costs and fund an interest reserve.

$42.9 Million

Hospitality

Nashville, TN

BSP provided a $42.9MM floating-rate loan on a 191-key full-service hotel located in Nashville, TN. The loan was used to acquire the asset, future fund a PIP reserve, fund other reserves, and pay closing costs.

$17.0 Million

Hospitality

Tampa, FL

BSP provided a $17.0MM fixed-rate loan on a 124-key, limited-service 2020-built hospitality asset located in Tampa, FL. The loan was used to refinance the asset, pay off an existing loan, pay closing costs and repatriate capital to the Sponsor.

$24.8 Million

Multifamily

Arlington, TX

BSP provided a $24.8MM floating-rate loan on a 252-unit, garden-style multifamily asset located in Arlington, TX. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$38.75 Million

Multifamily

Katy, TX

BSP provided a $38.75MM floating-rate loan on a newly built, 230-unit multifamily asset located in Katy, TX. The loan was used to refinance the asset, fund reserves and pay closing costs.

$42.75 Million

Multifamily

San Antonio, TX

BSP provided a floating-rate loan of $42.75MM on a 328-unit garden-style multifamily property located in San Antonio, TX. The loan was used to refinance the asset.

$31.3 Million

Hospitality

Tampa, FL

BSP provided a $31.3MM floating-rate senior loan on a 325-key full-service hospitality asset located in Tampa, FL. The loan was used to refinance the asset and pay closing costs.

$17.0 Million

Hospitality

Peachtree Corners, GA

BSP provided a $17.0MM floating-rate loan on a 220-key full-service hotel property located in Peachtree Corners, GA. The loan was used to acquire the asset, fund a PIP reserve, fund a deferred maintenance reserve, fund other reserves, and pay closing costs.

$27.0 Million

Hospitality

Jacksonville, FL

BSP provided a $27.0MM floating-rate loan on a 221-key limited-service hotel portfolio located in Jacksonville, FL. The loan was used to acquire the two assets, fund a PIP reserve, and pay closing costs.

$29.3 Million

Multifamily

North Fort Meyers, FL

BSP provided a $29.3MM floating-rate loan on a 448-lot manufactured housing community located in North Fort Meyers, FL. The loan was used to acquire the asset, fund a capex reserve, fund other reserves and pay closing costs.

$80.0 Million

Multifamily

Austin, TX

BSP provided an $80.0MM floating-rate loan on a 272-unit, 30-story, 2021-vintage luxury high-rise multifamily property located in Downtown Austin, TX. The loan was used to refinance the asset, future fund a shortfall reserve and pay closing costs.

$33.4 Million

Multifamily

Washington, D.C

BSP provided a floating-rate loan of $33.4MM on a two-building, 217-unit short term rental/multifamily portfolio, uniquely located in the Georgetown neighborhood of Washington, D.C. The loan was used to refinance the asset.

$34.25 Million

Hospitality

Orlando, FL

BSP provided a $34.25MM fixed-rate loan on a 259-key, select-service 2020-built hospitality asset located in Orlando, FL. The loan was used to refinance the asset, pay off an existing EB5 loan, fund a seasonality reserve, and pay closing costs.

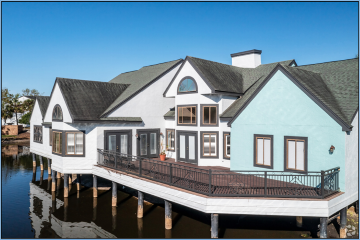

$26.25 Million

Hospitality

Cape May, NJ

BSP provided a $26.25MM fixed-rate loan on a 70-key full-service hospitality asset located along the award winning beaches of Cape May, NJ. The loan was used to refinance the asset and pay closing costs.

$64.5 Million

Multifamily

Davenport, FL

BSP provided a $64.5MM floating-rate loan on a 360-unit, garden-style, newly built multifamily asset located in Davenport (Reunion Village), FL. The loan was used to refinance the asset, fund a remaining construction reserve, fund other reserves and pay closing costs.

$15.75 Million

Multifamily

Branson, MO

BSP provided a $15.75MM fixed-rate loan on a 325-unit, mid-rise multifamily asset (recently converted from hotel) located in Branson, MO. The loan was used to refinance the asset, fund upfront reserve, pay closing costs and repatriate capital to the Sponsor.

$10.5 Million

Hospitality

Miami, FL

BSP provided a $10.5MM floating-rate loan on a 77-key, limited service hotel asset, located in Miami Beach, FL. The loan was used to acquire the asset, fund reserves and pay closing costs.

$55.5 Million

Multifamily

Phoenix, AZ

BSP provided a $55.5MM floating-rate loan on a 320-unit, high-rise, newly built multifamily asset located in Phoenix, AZ. The loan was used to refinance the asset, fund a capex and TILC reserve, fund other reserves and pay closing costs.

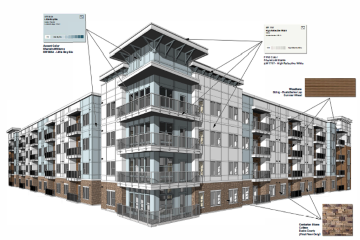

$40.9 Million

Multifamily

Philadelphia, PA

BSP provided a $40.9MM senior construction loan on a to-be-built, 182-unit multifamily complex located in Philadelphia, PA. The complex will be comprised of a 158-unit, 7-story, mid-rise residential building along with 24 connected townhome units. BSP also sourced a $7.0MM mezzanine loan that closed simultaneously with the senior loan and is held by a third-party lender. The total loan of $47.9MM was used to acquire the land, fund construction costs, fund reserves and pay closing costs.

$120.0 Million

Hospitality

Various Locations

BSP provided a $120.0MM senior floating-rate loan on a 1,313-key select-service hotel portfolio located within nine (9) suburban submarkets in CA, CT and NJ. The loan was used to refinance the Portfolio, fund a PIP reserve, fund other reserves and pay closing costs.

$28.3 Million

Hospitality

Wrightsville Beach, NC

BSP provided an $28.3MM senior floating-rate loan on a 151-key full-service hotel located in Wrightsville Beach, NC. The loan was used to acquire the Property, fund reserves and pay closing costs.

$15.15 Million

Multifamily

Spartanburg, SC

BSP provided a $15.15MM floating-rate loan on a 98-unit garden-style multifamily property located in Spartanburg, SC. The loan was used to acquire the asset, fund a capex reserve, and pay closing costs.

$3.6 Million

Office

Richmond, VA

BSP provided a $3.6MM fixed-rate loan on a ~31,000 SF medical office property located in Richmond, VA. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$17.1 Million

Hospitality

Yonkers, NY

BSP provided a $17.1MM floating-rate whole loan comprised of $15.75MM senior loan and a co-terminus $1.35MM mezzanine loan on a 150-key, limited-service hotel asset, located in Yonkers, NY. The loan was used to acquire the asset, fund reserves, future fund PIP and pay closing costs.

$8.0 Million

Retail

Hammon, IN

BSP rovided an $8.0MM fixed-rate on a ~89,000 SF retail center located in Hammond, IN. The loan was used to acquire the asset, fund TILC and Capex reserve, fund other reserves and pay closing costs.

$11.7 Million

Multifamily

Durham, NC

BSP provided an $11.7MM floating-rate loan on a 100-unit garden/low-rise style apartment property located in Durham, NC. The loan was used to acquire the asset, fund a capex reserve and pay closing costs.

$12 Million

Retail

Hoover, AL

BSP provided a $12.0MM fixed-rate loan on a ~137,000 SF anchored retail property, located in Hoover, AL. The loan was used to acquire the asset and pay closing costs.

$51.0 Million

Multifamily

Little River, SC

BSP provided a $51.0MM floating-rate loan on a 296-unit, garden/duplex-style multifamily portfolio, located in Little River, SC. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$9.99 Million

Multifamily

Fort Pierce, FL

BSP provided a $9.99MM fixed-rate on a 93-unit garden-style multifamily asset located in Fort Pierce, FL. The loan was used to refinance the asset, fund capex reserve, pay closing costs and repatriate capital to the Sponsor.

$34.3 Million

Multifamily

San Antonio, TX

BSP provided a $34.3MM floating-rate loan on a 344-unit, garden-style multifamily asset, located in San Antonio, TX. The loan was used to acquire the asset, future fund capex reserve, fund other reserves and pay closing costs.

$11.1 Million

Multifamily

Fayetteville, NC

BSP provided an $11.1MM floating-rate loan on a 96-unit garden style apartment asset located in Fayetteville, NC. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$8.25 Million

Multifamily

Fort Pierce, FL

BSP provided an $8.25MM fixed-rate on a 78-unit mid-rise multifamily asset located in Fort Pierce, FL. The loan was used to refinance the asset, pay closing costs and repatriate capital to the Sponsor.

$31.9 Million

Multifamily

Fayetteville, NC

BSP provided a $31.9MM floating-rate loan on a 233-unit garden/low-rise style apartment portfolio located in Fayetteville, NC. The loan was used to acquire one asset / recapitalize the other, future fund capex, fund other reserves and pay closing costs.

$20.2 Million

Multifamily

Kingsport, TN

BSP provided a $20.2MM floating-rate on a 168-unit garden-style multifamily asset located in Kingsport, TN. The loan was used to acquire the asset, future fund capex reserve, and pay closing costs.

$23.5 Million

Multifamily

Conyers, GA

BSP provided an $23.5MM floating-rate loan on a 128-unit garden style apartment asset located in Conyers, GA. The loan was used to acquire the asset, fund capex, fund other reserves and pay closing costs.

$17.5 Million

Multifamily

Nashville, TN

BSP provided a $17.5MM floating-rate on a 92-unit garden-style multifamily asset located in Nashville, TN. The loan was used to acquire the asset, future fund capex reserve, and pay closing costs.

$63.0 Million

Multifamily

Huntersville, NC

BSP provided a $63.0MM floating-rate loan on a to-be-completed 297-unit multifamily property located in Huntersville, NC. The loan was used to refinance the asset, fund hard and soft costs, fund other reserves and pay closing costs.

$68.0 Million

Multifamily

San Antonio, TX

BSP provided a $68.0MM floating-rate on a to-be-completed 375-unit multifamily asset located in San Antonio, TX. The loan was used to fund the construction of the asset (inclusive of hard and soft costs) and pay closing costs.

$37.9 Million

Multifamily

Las Vegas

BSP provided a $37.9MM floating-rate loan on a to-be-completed 160-unit townhome-style apartment property located in Las Vegas, NV. The loan was used to refinance the asset, fund hard and soft costs, fund other reserves and pay closing costs.

$57.5 Million

Multifamily

Norfolk, VA

BSP provided a $57.5MM floating-rate on a 307-unit/913-bed student housing asset located in Norfolk, VA. The loan was used to acquire the asset, fund capex reserve, and pay closing costs.

$39.5 Million

Hospitality

Washington, D.C

BSP provided a $39.5MM floating-rate loan on a 152-key extended-stay hotel property located in Washington, D.C. The loan was used to acquire the asset, fund soft costs, fund renovation capital, fund other reserves and pay closing costs.

$86.0 Million

Multifamily

Jersey City, NJ

BSP provided an $86.0MM floating-rate on a 362-unit mid-rise multifamily asset located in Jersey City, NJ. The loan was used to refinance the asset, fund TILC reserve, fund capex reserve, fund ground lease reserve, fund other reserves, pay closing costs and repatriate capital to the Sponsor.

$58.3 Million

Multifamily

Las Vegas, NV

BSP provided a $58.3MM floating-rate loan on a to-be-completed 308-unit apartment property and adjacent vacant land located in Las Vegas, NV. The loan was used to acquire the land parcels, fund hard and soft costs, fund other reserves and pay closing costs.

$10.8 Million

Hospitality

Asheville, NC

BSP provided a $10.8MM floating-rate on a 111-key, full-service hotel located in Asheville, NC. The loan was used to acquire the asset, fund reserves, future fund Capex and pay closing costs.

$85.5 Million

Multifamily

Kannapolis and Asheville, NC

BSP provided an $85.5MM floating-rate loan on a 430-unit garden/low-rise style apartment portfolio located in Kannapolis and Asheville, NC. The loan was used to acquire the assets and pay closing costs.

$82.0 Million

Multifamily

Fort Myers, FL

BSP provided an $82.0MM floating-rate loan on a 300-unit, garden-style multifamily asset, located in Fort Myers, FL. The loan was used to acquire the asset, fund a capex reserve, fund other reserves and pay closing costs.

$13.0 Million

Hospitality

Chester, VA

BSP provided a $13.0MM fixed-rate on a 136-key, limited-service hotel located in Chester, VA. The loan was used to refinance the asset, pay closing costs and return equity to the Sponsor.

$10.0 Million

Retail

Addison, IL

BSP provided an $10.0MM fixed-rate loan on a ~115,000 SF multi-tenant retail asset, located in Addison, IL. The loan was used to acquire the asset, fund a TILC reserve, fund other reserves and pay closing costs.

$42.7 Million

Multifamily

Newport News, VA

BSP provided an $42.7MM floating-rate loan on a 552-unit, garden-style multifamily asset, located in Newport News, VA. The loan was used to acquire the asset, future fund capex, fund other reserves and pay closing costs.

$24.4 Million

Multifamily

Smyrna, GA

BSP provided an $24.4MM floating-rate loan on a 148-unit, townhome-style multifamily asset, located in Smyrna, GA. The loan was used to acquire the asset, future fund a capex reserve, fund other reserves and pay closing costs.

$54.0 Million

Industrial

Chicago, IL

BSP provided an $54.0MM fixed-rate loan on a ~793,000 SF warehouse and cold storage facility located in Chicago, IL. The loan was used to refinance the asset, fund a TILC reserve, fund other reserves and pay closing costs.

$25.6 Million

Industrial

Southwest, FL

BSP provided a $25.6MM floating-rate senior loan on a 300k+ sf industrial portfolio in southwest Florida. The loan was used to acquire the properties, fund reserves, future fund a TI/LC reserve and pay closing costs.

$235 Million

Multifamily

Miami, FL

BSP provided a $235MM floating-rate senior loan secured by 646 residential condominium units along with ~52,000 sf of commercial space in Miami, FL. The loan was used to refinance the asset, fund reserves, and pay closing costs.

$6.55 Million

Hospitality

Binghamton, NY

BSP provided an $6.55MM fixed-rate loan on a 78-key limited-service hotel located in Binghamton, NY. The loan was used to refinance the asset, fund a PIP reserve, fund other reserves and pay closing costs.

$13.4 Million

Multifamily

Lake Placid, FL

BSP provided a $13.4MM floating-rate loan on a 411-lot manufactured housing and RV community located in Lake Placid, FL. The loan was used to acquire the asset, fund a capex reserve, fund other reserves and pay closing costs.

$18.2 Million

Hospitality

Huntsville & Athens, AL

BSP provided an $18.2MM floating-rate loan on a 190-key limited-service hotel portfolio located in Huntsville and Athens, AL. The loan was used to acquire the Portfolio, future fund a PIP reserve, fund other reserves and pay closing costs.

$11.3 Million

Multifamily

Lebanon, TN

BSP provided an $11.3MM floating-rate loan on a 108-unit, garden-style multifamily asset, located in Lebanon, TN (near Nashville, TN). The loan was used to acquire the asset, future fund capex reserve, and pay closing costs.

$18.6 Million

Multifamily

Louisville, KY

BSP provided an $18.6MM floating-rate loan on a 107-unit, mid-rise-style multifamily asset, located in Louisville, KY. The loan was used to acquire the asset, fund a capex reserve, fund other reserves and pay closing costs.

$65.3 Million

Multifamily

Charlotte, NC

BSP provided an $65.3MM floating-rate loan on a 360-unit, mid-rise-style to-be-built multifamily asset, located in Charlotte, NC. The loan was used to acquire the land, fund hard and soft costs for the development of the asset, fund other reserves and pay closing costs.

$70.75 Million

Multifamily

Pooler, GA

BSP provided a $70.75MM floating-rate loan on a 380-unit, garden-style multifamily asset, located in Pooler, GA. The loan was used to acquire the asset, fund reserves and pay closing costs.

$24.45 Million

Hospitality

Nashville, TN

BSP provided a $24.45MM floating-rate loan on an 86-key full service hotel located in Nashville, TN. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$35.7 Million

Multifamily

Tempe, AZ

BSP provided a $35.7MM floating-rate loan on a 172-unit, garden-style multifamily asset, located in Tempe, AZ. The loan was used to acquire the asset, future fund capex, fund other reserves and pay closing costs.

$31.4 Million

Hospitality

Columbia, SC

BSP provided a $31.4MM floating-rate loan on a 223-key limited-service dual-branded hotel located in Columbia, SC. The loan was used to acquire the asset, fund a PIP reserve, fund other reserves and pay closing costs.

$70.75 Million

Multifamily

Savannah, GA

BSP provided a $70.75MM floating-rate loan on a 320-unit garden-style multifamily property located in Savannah, GA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$56.0 Million

Multifamily

Lexington, KY

BSP provided a $56.0MM floating-rate loan on a 384-unit, garden-style multifamily asset, located in Lexington, KY. The loan was used to acquire the asset, fund a capex reserve, and pay closing costs.

$17.6 Million

Multifamily

Los Angeles, CA

BSP provided a $17.6MM floating-rate loan on a to-be-completed, 65-unit multifamily property, located in Los Angeles, CA. The loan was used to refinance the asset, fund reserves, and pay closing costs.

$40.0 Million

Retail

Cookeville, TN

BSP provided a $40.0MM fixed-rate loan on a ~228,000 SF anchored retail property, located in Cookeville, TN. The loan was used to refinance the asset and pay closing costs.

$16.0 Million

Retail

Covington, VA

BSP provided a $16.0MM fixed-rate loan on ~120,000 SF retail property located in Covington, VA. The loan was used to refinance the asset, fund upfront TILC reserve, fund other reserves, and pay closing costs.

$65.0 Million

Retail

Chattanooga, TN

BSP provided a $65.0MM fixed-rate loan on a ~467,000 SF anchored retail property, located in Chattanooga, TN. The loan was used to refinance the asset and pay closing costs.

$13.1 Million

Multifamily

Katy, TX

BSP provided a $13.1MM floating-rate loan on a 120-unit, garden-style multifamily asset, located in Katy, TX. The loan was used to acquire the asset, future fund capex reserve, and pay closing costs.

$18.5 Million

Retail

Spring, TX

BSP provided an $18.5MM fixed-rate loan on a ~90,000 SF shadow-anchored retail property, located in Spring, TX. The loan was used to acquire the asset and pay closing costs.

$15.7 Million

Office

Katy, TX

BSP provided $15.7MM floating-rate loan on a 137,000 SF suburban office property located in Katy, TX. The loan was used to refinance the asset, fund reserves, future fund a TILC reserve, and pay closing costs.

$41.0 Million

Hospitality

Vail, CO

BSP provided a $41.0MM floating-rate construction loan on an 243-key, dual-branded hospitality property located in Vail, CO. The loan was used to acquire the land, fund hard and soft costs, fund other reserves, and pay closing costs.

$42.3 Million

Multifamily

Austin, TX

BSP provided a $42.3MM floating-rate loan on a 249-unit, garden-style multifamily asset, located in Austin, TX. The loan was used to acquire the asset, future fund capex reserve, and pay closing costs.

$28.5 Million

Retail

Trinity, FL

BSP provided a $28.5MM fixed-rate loan on a anchored retail asset, located in Trinity, FL. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$27.2 Million

Retail

Henderson, NV

BSP provided an $27.2MM floating-rate loan on a ~172,000 SF retail property located in Henderson, NV. The loan was used to acquire the asset, fund reserves, future fund reserves for TILC and Capex and pay closing costs.

$41.1 Million

Multifamily

Dallas, TX

BSP provided a $41.1MM floating-rate loan on a 218-unit, garden-style multifamily asset, located in Dallas, TX. The loan was used to acquire the asset, fund reserves, future fund capex reserve, and pay closing costs.

$19.0 Million

Retail

Multifamily

New York, NY

BSP provided a $19.0MM senior loan and a co-terminus $1.0MM mezzanine loan encumbering a 65-apartment unit / ~4,400 SF of ground floor commercial space mixed-use asset located in Manhattan (New York, NY). The loan was used to refinance the asset, fund reserves, repatriate equity to the Sponsor and pay closing costs.

$39.5 Million

Multifamily

Tyler, TX

BSP provided a $39.5MM floating-rate loan on a 483-unit, garden-style multifamily asset, located in Tyler, TX. The loan was used to acquire the asset, future fund Capex reserve, and pay closing costs.

$50.9 Million

Hospitality

Atlanta, GA

BSP rovided a $50.9MM floating-rate loan on a 315-key, full service hotel, located in Atlanta, GA. The loan was used to acquire the asset, fund reserves, future fund PIP reserve, and pay closing costs.

$100.6 Million

Multifamily

St John County, FL

BSP provided an $89.5MM senior construction loan and a co-terminus $11.1MM senior mezzanine loan encumbering a to-be-developed, 418-unit, class-A multifamily complex located in St. Johns County, FL. The loan was used to acquire the land, fund construction of the asset and associated infrastructure, fund soft costs, fund reserves and pay closing costs.

$21.0 Million

Multifamily

New York, NY

BSP provided $19.5MM senior loan and a co-terminus $1.5MM mezzanine loan encumbering a 63-unit, three-property multifamily portfolio located in Manhattan (New York, NY). The loan was used to acquire the asset, fund reserves, future fund Capex and TILC reserve, and pay closing costs.

$13.1 Million

Multifamily

Hospitality

New Orleans, LA

BSP provided a $13.1MM fixed-rate loan on a 181-key hospitality asset, located in New Orleans MSA (Metairie, LA). The loan was used to acquire the asset, fund PIP reserve, and pay closing costs.

$40.25 Million

Retail

Agoura Hills, CA

BSP provided a $40.25MM fixed-rate loan on a ~137K+ SF anchored retail property located in Agoura Hills, (Los Angeles County), CA. The loan was used to refinance the existing asset, acquire the adjacent parcel, fund reserves, and pay closing costs.

$39.0 Million

Hospitality

Ocean City, MD

BSP provided an $39.0MM floating-rate loan on an 250-key limited service hotel located in Ocean City, MD. The loan was used to acquire the asset, fund reserves, future fund capex, and pay closing costs.

$11.0 Million

Hospitality

Lansdale, PA

BSP provided a ~$11.0MM floating-rate loan on a 170-key, extended stay hospitality property located in Lansdale, PA. The loan was used to acquire the asset, fund reserves, future fund PIP and pay closing costs.

$12.9 Million

Multifamily

Memphis, TN

BSP provided an $12.9MM floating-rate loan on a 167-unit, garden-style property located in Memphis, TN. The loan was used to acquire the asset, future fund capex and pay closing costs.

$20.6 Million

Multifamily

Various, IL

BSP provided a $20.6M floating-rate loan on a 609-pad (624-unit) manufactured housing community, located throughout northeastern Illinois. The loan was used to acquire the asset, fund reserves, fund capex and pay closing costs.

$61.2 Million

Multifamily

Ann Arbor, MI

BSP provided an $61.2MM floating-rate loan on an 324-unit, garden-style multifamily property located in Ann Arbor, MI. The loan was used to acquire the asset, fund reserves, future fund capex, and pay closing costs.

$27.9 Million

Multifamily

Smyrna, GA

BSP provided a $27.9MM floating-rate loan on a 190-unit garden-style multifamily property located in Smyrna, GA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$34.3 Million

Office

Herndon, VA

BSP provided a $34.3MM fixed-rate loan on a ~332,000 SF office property, located in Herndon, VA. The loan was used to refinance the asset, fund TILC, and pay closing costs.

$50.9 Million

Multifamily

Atlanta, GA

BSP provided a $50.9MM floating-rate loan on a 224-unit mid-rise multifamily property located in Atlanta, GA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$33.2 Million

Multifamily

San Antonio, TX

BSP provided a $33.2MM floating-rate loan on a 280-unit garden-style multifamily property, located in San Antonio, TX. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$59.1 Million

Multifamily

Garland, TX

BSP provided an $59.1MM floating-rate loan on an 338-unit, garden-style multifamily property located in Garland, TX. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$38.9 Million

Multifamily

Corpus Christi, TX

BSP provided a $38.9MM floating-rate loan on a 348-unit garden-style multifamily property, located in Corpus Christi, TX. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$37.4 Million

Multifamily

Jacksonville, FL

BSP provided a $37.4MM floating-rate loan on a 192-unit garden-style multifamily property located in Jacksonville, FL. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$35.0 Million

Multifamily

Orlando, FL

BSP provided a $35.0MM floating-rate loan on a 330-unit garden-style multifamily property, located in Orlando, FL. The loan was used to acquire the asset, future fund capex and pay closing costs.

$46.9 Million

Multifamily

Fort Worth, TX

BSP provided a $46.9MM floating-rate loan on a 314-unit garden-style multifamily property, located in Fort Worth, TX. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$63.0 Million

Multifamily

Charlotte, NC

BSP provided a ~$63.0MM floating-rate loan on a 309-unit multifamily property located in Charlotte, NC. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$27.7 Million

Office

Tampa, FL

BSP provided a ~$27.7MM floating-rate loan on a ~175,000 SF suburban office property located in Tampa, FL. The loan was used to acquire the asset, fund reserves, future fund capex and TILC and pay closing costs.

$23.2 Million

Multifamily

Norcross, GA

BSP provided a $23.2MM floating-rate loan on a 288-unit garden-style multifamily property located in Norcross, GA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$62.9 Million

Multifamily

Summerville, SC

BSP provided a $62.9MM floating-rate loan on a 300-unit mid-rise multifamily property, located in Summerville, SC. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$74.0 Million

Multifamily

New York, NY

BSP provided a $74.0MM floating-rate senior loan + $10.0MM coterminous mezzanine loan on a 134-unit multifamily property located in New York, NY. The loan was used to acquire the asset, fund reserves, future fund capex to convert the property from hotel to conventional multifamily and pay closing costs.

$17.4 Million

Office

Tulsa, OK

BSP provided a $17.4MM fixed-rate loan on a ~550K+ SF office property located in Tulsa, OK. The loan was used to refinance the asset, fund an upfront TILC reserve, fund other reserves and pay closing costs.

$49.6 Million

Multifamily

Dallas, TX

BSP provided a $49.6MM floating-rate loan on a 466-unit garden-style multifamily project, located in Dallas, TX. The loan was used to acquire the asset, fund reserves, future fund capex reserve for renovations and closing costs.

$32.4 Million

Multifamily

Kileen, TX

BSP provided a $32.4MM floating-rate loan on a 266-unit garden-style multifamily property, located in Killeen, TX. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$8.5 Million

Hospitality

Middleburg, FL

BSP provided an $8.5MM fixed-rate loan on an 81-key, hospitality property located in Middleburg, FL. The loan was used to refinance the asset, fund reserves, pay closing costs and repatriate capital to the Sponsor.

$18.0 Million

Office

Alexandria

BSP provided a ~$18.0MM fixed-rate loan on a ~148K+ SF multi-tenant office property, located in Alexandria, VA. The loan was used to refinance the asset, fund an upfront TILC reserve, fund other reserves and pay closing costs.

$23.3 Million

Multifamily

Nashville, TN

BSP provided a $23.3MM floating-rate loan on a 201-unit multifamily property located in Nashville, TN. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$27.4 Million

Multifamily

Nashville, TN

BSP provided a $27.4MM floating-rate loan on a 235-unit multifamily property located in Nashville, TN. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$70.1 Million

Multifamily

Pflugerville, TX

BSP provided a $70.1MM floating-rate loan on a 455 unit garden-style multifamily project, located in Pflugerville (Austin suburb), TX. The loan was used to acquire the asset, and fund a meaningful renovation of the asset.

$13.0 Million

Retail

Salem, OR

BSP provided a $13.0MM fixed-rate loan on a 135K+ SF retail property located in Salem, OR. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$30.6 Million

Multifamily

Shoreline, WA

BSP provided a $30.6MM floating-rate loan on a 124-unit, mid-rise multifamily property located in Shoreline, WA. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$88.5 Million

Office

Retail

Multifamily

Washington, DC

BSP provided an $88.5MM floating-rate loan on a 389 dwelling unit, mixed-use property located in Washington, DC. The loan was used to acquire the asset, fund reserves and pay closing costs.

$5.4 Million

Retail

Bel Air, MD

BSP provided a $5.4MM fixed-rate loan on a 14K+ SF single tenant investment grade retail property located in Bel Air, MD. The loan was used to acquire the asset and pay closing costs.

$13.6Million

Multifamily

Pittsburgh, PA

BSP provided a $13.6MM floating-rate loan on a 210-unit, garden-style multifamily property located in Pittsburgh, PA. The loan was used to acquire the asset, fund reserves, future fund renovations and pay closing costs.

$19.1Million

Multifamily

Austin, TX

BSP provided a $19.1MM floating-rate loan on a 247-unit, garden-style multifamily property located in Austin, TX. The loan was used to acquire the asset, fund reserves, future fund capex to convert the properties from hotels to conventional multifamily assets and pay closing costs.

$11.2 Million

Multifamily

Port Huron, MI

BSP provided a $11.2MM floating-rate loan on a 208-unit, garden-style multifamily property located in Port Huron, MI. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$36.8 Million

Multifamily

Temple Terrace, FL

BSP provided a $36.8MM floating-rate loan on a 290-unit (post renovation) multifamily property located in Temple Terrace, Fl. The loan was used to acquire the asset, fund reserves, future fund capex ($13.2MM) and pay closing costs.

$40.1 Million

Multifamily

Kyle, TX

BSP provided a $40.1MM floating-rate loan on a 264-unit, garden-style multifamily property located in Kyle, TX. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$16.65 Million

Multifamily

Irving, TX

BSP provided a $16.65MM floating-rate loan on a 228-unit, garden-style multifamily property located in Irving, TX. The loan was used to acquire the asset, fund reserves, future capex and pay closing costs.

$14.5 Million

Multifamily

Copperas Cove and Nacogdoches, TX

BSP provided a $14.5MM floating-rate loan on a 278-unit, garden-style multifamily portfolio located in Copperas Cove and Nacogdoches, TX. The loan was used to acquire the asset, fund reserves, future capex and pay closing costs.

$11.3 Million

Multifamily

Warner Robins, GA

BSP provided a $11.3MM floating-rate loan on a ~200-unit, 3-property multifamily portfolio located in Warner Robins, GA. The loan was used to acquire the assets, fund reserves, future fund capex and pay closing costs.

$27.68 Million

Multifamily

Arlington, TX

BSP provided an $27.68MM floating-rate SBL loan on a 272-unit multifamily property located in Arlington, TX. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$21.25 Million

Multifamily

Austin, TX

BSP provided a $21.25MM floating-rate loan on a 156-unit, garden-style multifamily property located in Austin, TX. The loan was used to acquire the asset, fund reserves, future fund capex (~$2.5MM) and pay closing costs.

$17.37 Million

Hospitality

Waco, TX

BSP provided a $17.37MM floating-rate loan on a 202-key, extended-stay/limited-service hospitality portfolio (comprised of two individual assets) located in Waco, TX. The loan was used to acquire the asset, fund a capex reserve, fund shortfall reserve and pay closing costs.

$14.2Million

Multifamily

Tampa, FL

BSP provided an $14.2MM floating-rate loan on a 58-unit multifamily property located in Tampa, FL. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$48.7 Million

Multifamily

Pittsburg, PA

BSP provided a $48.7MM floating-rate loan on a 436-unit, garden-style multifamily property located in Pittsburg, PA. The loan was used to acquire the asset, fund reserves, future fund capex (~$14.6MM) and pay closing costs.

$15.4 Million

Multifamily

San Antonio, TX

BSP provided a $15.4MM floating-rate loan on a 224-unit, garden-style multifamily property located in San Antonio, TX. The loan was used to acquire the asset, fund reserves, future capex and pay closing costs.

$38.3 Million

Multifamily

Dallas, TX

BSP provided a $38.3MM floating-rate loan on a 651-unit garden-style multifamily portfolio comprised of three assets located in Dallas, TX. The loan was used to acquire the asset, fund reserves, future fund a capex reserve and pay closing costs.

$166.8 Million

Multifamily

St. John's, FL

BSP provided a $128.9MM senior construction loan and a co-terminus $37.9MM mezzanine loan on a to-be-developed, 844-unit, Class-A multifamily property located in St. John’s, FL. The loan was used to acquire the site, fund construction of the asset and associated infrastructure, fund reserves and pay closing costs.

$7.9 Million

Retail

Orlando, FL

BSP provided a $7.9MM fixed-rate loan on a 142K SF mixed-use (retail/flex) property located in Orlando, FL. The loan was used to acquire the asset (property acquired all cash in June 2021), fund reserves and pay closing costs.

$42.9 Million

Multifamily

Charleston, SC

BSP provided a $42.9MM floating-rate loan on a 220-unit, garden-style multifamily property located in Charleston, SC. The loan was used to acquire the asset, fund reserves and pay closing costs.

$31.9 Million

Multifamily

Arlington, TX

BSP provided a $31.9MM floating-rate loan on a 288-unit, A garden-style multifamily property located in Arlington, TX. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$26.5 Million

Multifamily

San Antonio

BSP provided a $26.5MM floating-rate loan on a 336-unit garden-style multifamily property located in San Antonio, TX. The loan was used to acquire the asset, fund reserves, future fund a capex reserve and pay closing costs.

$10.05 Million

Multifamily

Waco, TX

BSP provided a $10.05MM floating-rate loan on a 200-unit garden-style multifamily property located in Waco, TX. The loan was used to refinance the asset, fund a capex reserve to convert the property to traditional multifamily, fund other reserves and pay closing costs.

$6.87 Million

Retail

Hatillo, Puerto Rico

BSP provided a $6.87MM fixed-rate loan on a 15K+ SF single tenant investment grade retail property located in Hatillo, Puerto Rico. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$29.5 Million

Multifamily

Oakwood, GA

BSP provided a $29.5MM floating-rate loan on a 194-unit, newly constructed, Class-A garden-style multifamily property located in Oakwood, GA. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$11.3 Million

Multifamily

Greenville, SC

BSP provided an $11.3MM floating-rate loan on a 130-unit garden-style multifamily property located in Greenville, SC. The loan was used to acquire the asset, future fund capex and pay closing costs.

$32.5 Million

Multifamily

Lynwood, WAS

BSP provided a $32.5MM floating-rate loan on a 104-unit student housing property located in Lynwood, WA. The loan was used to pay off a construction loan, fund reserves, pay closing costs and return equity to the Sponsor.

$11.0 Million

Multifamily

Hartford, CT

BSP provided a $11.0MM fixed-rate loan on a 141-unit multifamily property located in Hartford, CT. The loan was used to refinance the asset, fund reserves, and pay closing costs.

$17.5 Million

Hospitality

Savannah, GA

BSP provided a $17.5MM floating-rate loan on 50-key, full-service hotel located in Savannah, GA. The loan was used to refinance the asset, and pay closing costs.

$40.2 Million

Multifamily

Orlando, FL

BSP provided a $40.2MM fully-funded, floating-rate loan on 360-unit, garden-style mulitfamily property located in Orlando, FL. The loan was used to acquire the asset, fund reserves, future fund capex for renovations and pay closing costs.

$10.8 Million

Retail

Deland, FL and San Tan Valley, AZ

BSP provided two cross-collateralized mortgage loans with a combined balance of $10.8MM on two investment grade, single-tenant retail properties in Deland, FL and San Tan Valley, AZ. The loan was used to acquire the assets and pay closing costs.

$37.5 Million

Hospitality

Orlando, FL

BSP provided a $37.5MM floating-rate loan on a 400-key, full-service hotel located in Orlando, FL. The loan was used to acquire the asset and provide funds for a full-scale renovation in connection with a re-flagging of the hotel.

$22.85 Million

Hospitality

Ashburn, VA

BSP provided a $22.85MM floating-rate loan on a 244-key, 2005-vintage, hotel portfolio located in Ashburn, VA. The loan was used to acquire the asset, fund reserves, future fund PIP and pay closing costs.

$7.07 Million

Hospitality

Hilton Head, SC

BSP provided a $7.07MM fixed-rate loan on a 99-key, limited-service hotel located in Hilton Head, SC. The loan was used to refinance the asset, fund reserves and pay closing costs.

$15.0 Million

Industrial

Summerville & Simpsonville, SC

BSP provided a $15.0MM floating-rate loan on a ~1,500-unit self-storage portfolio located in Summerville and Simpsonville, SC. The loan was used to refinance the asset, fund reserves and pay closing costs.

$27.5 Million

Hospitality

New Orleans, LA

BSP provided a $27.5MM floating-rate loan on a 171-key, full service hotel property located in New Orleans, LA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$32.2 Million

Multifamily

Corpus Christi, TX

BSP provided a $32.2MM floating-rate loan on a 336-unit garden-style multifamily property located in Corpus Christi, TX. The loan was used to acquire the asset, future fund capex, and pay closing costs.

$14.2 Million

Multifamily

Union City, GA

BSP provided a $14.2MM floating-rate loan on a 191-unit multifamily property located in Union City, GA. The loan was used to acquire the asset, future fund capex, fund other reserves and pay closing costs.

$48.0 Million

Multifamily

Torrance, CA

BSP provided a $48.0MM fixed-rate loan on a 176-unit, midrise multifamily property located in Torrance, CA. The loan was used to refinance the asset and pay closing costs.

$30.5 Million

Office

Herndon, VA

BSP provided a $30.5MM fixed-rate loan on a ~265,000 SF, office/flex property located in Herndon, VA (Dulles/Washington corridor). The loan was used to refinance the asset, fund an upfront TILC reserve, and pay closing costs.

$13.6 Million

Multifamily

Houston, TX

BSP provided a $13.6MM floating-rate loan on a 251-unit multifamily property located in Houston, TX. The loan was used to acquire the asset, fund an upfront capex reserve, fund other reserves, and pay closing costs.

$8.9 Million

Multifamily

Morrisville, PA

BSP provided an $8.9MM floating-rate loan on an 80-unit, garden-style multifamily property located in Morrisville, PA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$12.9 Million

Multifamily

Corpus Christi MSA

BSP provided a $12.9MM floating-rate loan on a 200-unit, garden-style multifamily property located in the Corpus Christi MSA. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$7.66 Million

Retail

Batamon, PR

BSP provided a $7.7MM fixed-rate loan on a 15,660 SF single-tenant retail property located in Bayamón, Puerto Rico. The loan was used to acquire the asset and pay closing costs. C

$12.2 Million

Multifamily

Amarillo, TX

BSP provided a $12.2MM floating-rate senior loan on a 411-unit garden-style multifamily property located in Amarillo, TX. The loan was used to acquire the asset, fund reserves, future fund capex and pay closing costs.

$12.3 Million

Multifamily

Lubbock, TX

BSP provided a $12.3MM floating-rate loan on a 236-unit garden-style multifamily property located in Lubbock, TX. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$54.5 Million

Multifamily

Houston, TX

BSP provided a $54.5MM floating-rate loan on a 504-unit garden-style multifamily property located in Houston, TX. The loan was used to refinance existing debt, fund reserves, and pay closing costs.

$55.0 Million

Multifamily

Houston, TX

BSP provided a $55.0MM floating-rate senior loan on a 618-unit garden-style multifamily property located in Houston, TX. The loan was used to acquire the asset, fund reserves, future fund Capex reserves and pay closing costs.

$32.0 Million

Hospitality

Charlotte, NC

BSP provided a $32.0MM floating-rate whole loan on a 180-key, extended-stay hotel located in Charlotte, NC. The loan was used to refinance the asset, fund an interest reserve, fund other reserves and pay closing costs.

$21.0 Million

Multifamily

St. Louis, MO

BSP provided a $21.0MM floating-rate loan on a newly developed, Class A, 111-unit apartment property located in St. Louis, MO. The loan was used to payoff existing construction loan, fund reserves, pay closing costs and repatriate capital to the Sponsor.

$9.2 Million

Retail

Chapel Hill, NC

BSP provided a $9.2MM fixed-rate loan on an ~86,000 SF grocery-anchored retail property located in Chapel Hill, NC. The loan was used to acquire the asset, fund reserves, and pay closing costs.

$48.0 Million

Office

Retail

Bethesda, MD

BSP provided a $48.0MM fixed-rate loan on a ~145,000 SF mixed-use property located in Bethesda, MD. The loan was used to refinance the asset, fund an upfront rollover reserve, fund outstanding TILC, and pay closing costs.

$12.99 Million

Multifamily

Houston, TX

BSP provided a $12.99MM floating-rate loan on a ~150-unit garden-style multifamily property located in Houston, TX. The loan was used to acquire the asset future fund capex and pay closing costs.

$10.9MM SENIOR LOAN + $1.5MM MEZZ LOAN

Multifamily

Tallahassee, FL

BSP provided a $10.9MM floating-rate senior loan + $1.5MM mezzanine loan on a recently renovated, 160-unit garden-style multifamily property located in Tallahassee, FL. The loan was used to refinance existing debt, fund reserves, and pay closing costs.

$18.4 Million

Industrial

Glendale, AZ

BSP provided an $18.4MM loan on a 620,000 SF industrial building in Glendale, AZ. The loan was used to acquire the property, fund upfront reserves, fund TI/LC via a future funding facility and cover closing costs.

$69.8 Million

Office

Morristown, NJ

BSP provided a $69.8MM floating-rate loan on a 413k SF, Class-A office property located in Morristown, NJ. The loan was used to fund renovations, fund future funding reserves for lease-up and cover closing costs.

$14.65 Million

Industrial

Waite Park, MN

BSP provided a $14.65MM floating-rate loan on an approximately 300,000 SF cold-storage facility located in Waite Park, MN. The loan was used to acquire the property, fund reserves, and cover closing costs.

$7.2 Million

Multifamily

Fort Pierce, Fl

BSP provided a $7.2MM floating-rate loan on a newly constructed 78-unit garden multifamily property located in Fort Pierce, FL. The loan was used to refinance the property, fund reserves, cover closing costs and repatriate equity to the Sponsor.

$6.0 Million

Office

Newark, DE

BSP provided a $6.0MM fixed-rate loan on a 77,000 SF suburban office property located in Newark, DE. The loan was used to refinance existing debt, fund reserves, and cover closing costs.

$17.5 Million

Retail

Weaverville, NC

BSP provided a $17.5MM fixed-rate loan on a 134,000 SF grocery-anchored retail center located in Weaverville, NC. The loan was used to acquire the property, fund reserves, and cover closing costs.

$37.3 Million

Office

Portland, OR

BSP provided a $37.3MM floating-rate loan on a CBD office property located in Portland, OR. The loan was used to acquire the property, fund a repositioning of the asset, and cover closing costs.

$12.3 Million

Multifamily

Odessa, TX

BSP provided a $12.3MM floating-rate loan on a 181-unit garden-style multifamily property located in Odessa, TX. The loan was used to acquire the property, fund renovations via an earnout structure, and cover closing costs.

$42.0 Million

Multifamily

North Richland Hills, TX

BSP provided a $44M floating-rate loan on a 316 unit multifamily asset located in North Richland Hills, TX. The loan was used to refinance property, cover closing costs and return equity to the Sponsor.

$16.75 Million

Industrial

Santa Fe Springs & Fresno, CA and Phoenix, AZ

BSP provided a $16.75MM senior loan on a three property, 232,479 SF industrial portfolio located in Santa Fe Springs and Fresno, CA and Phoenix, AZ. The loan was used to refinance the property, fund an immediate repairs reserve, cover closing costs and return equity to the Sponsor.

$15.5 Million

Multifamily

Spring, TX

BSP provided a $15.5MM loan on a to-be 180-unit garden-style multifamily property located in Spring, TX. The loan was used to acquire the property, fund renovations to complete the construction of 30 units, and cover closing costs.

$12.8 Million

Retail

West Columbia, SC

BSP provided a $12.8MM senior loan on a 98% occupied, grocery-anchored retail center located in West Columbia, SC. The loan was used to pay off existing debt, fund TI/LC reserves, cover closing costs, and return equity to the borrower.

$25.4 Million

Industrial

Detroit, MI

BSP provided a $25.4MM floating-rate loan on a 1.2MM SF industrial complex located in Detroit, MI. The loan was used to acquire the property, fund reserves, and cover closing costs. The loan provides the borrower with the flexibility needed to execute its business plan.

$14.2 Million

Hospitality

Bolingbrook, IL

BSP provided a $14.2MM fixed-rate loan on a 155-key, select service hotel located in Bolingbrook, IL. The loan was used to payoff existing debt and cover closing costs.

$5.0 Million

Hospitality

Lexington Park, MD

BSP provided a $5.0MM fixed-rate loan on a 78-key limited service hotel located in Lexington Park, MD. The loan was used to refinance the property, fund a PIP Reserve, and cover closing costs.

$11.0 Million

Multifamily

Brooklyn, NY

BSP provided an $11MM loan on a 28 unit mid-rise multifamily property located in Brooklyn, NY. The loan was used to refinance an existing construction loan and cover closing costs.

$9.5 Million

Multifamily

Lafayette, LA

BSP provided a $9.5MM floating rate loan on a 264 unit garden-style multifamily property located in Lafayette, LA. The loan was used to acquire the property, fund renovations, and cover closing costs.

$128.9 Million of future funding + $37.9 M ($31.38M of future funding) Mezz

Multifamily

Jacksonville, FL

BSP provided a $128.9 million senior construction loan and BSP provided a co-terminus $37.9 million mezz loan to finance the construction of two, to-be completed, class-A multifamily complexes that will comprise of 844 units on +/- 52 acres of land in Jacksonville, Fl.

$60.2 Million

Multifamily

Fort Worth, TX

BSP provided a $60.2 million floating-rate loan to a repeat BSP borrower to finance the acquisition of a 369-unit multifamily complex located in Fort Worth, TX. The Loan was structured with future funding for capex.

$44.4 Million

Multifamily

Dallas, TX

BSP provided a $44.4 million floating-rate loan to a repeat BSP borrower to finance the acquisition of a 321-unit multifamily complex located in Dallas, TX. The loan was structured with future funding for capex.

$42.2 Million

Industrial

Las Vegas, NV

BSP acquired a $42.2 million floating-rate A-Note position on a $70.3 million Whole Loan to finance the completion of a to-be completed 5 building, 725K SF Class A industrial warehouse and distribution complex located in North Las Vegas, NV.

$39.7 Million Senior Loan and $6.8 Mezzanine Loan

Office

East Brunswick, NJ

BSP provided a $39.7 million floating-rate loan comprised of a $25.9 million senior loan and a co-terminus $6.8 million mezz loan to finance the acquisition of a 412K SF office tower located in East Brunswick, NJ. The Loan was structured with future funding for capex and TILC.

$33.0 Million

Office

Alpharetta, GA

BSP provided a $33.0 million floating-rate loan to finance the acquisition of a two-building, 270K SF Class A, suburban office property and an adjacent developable pad in Alpharetta, GA. The loan is structured with future funding for capex and TILC.

$17.5 Million

Hospitality

Savannah, GA

BSP provided a $17.5 million floating-rate loan to refinance a newly constructed, 50-key, full-service unflagged, boutique hotel and adjacent building with 4 short-term rental apartments in the Historic District in Savannah, GA.

$12.5MM Equity / $29.2MM Senior

Office

Jeffersonville, IN

BSP provided a $29.2 million fixed-rate loan to finance the acquisition of a 226K SF single-tenant, 100% occupied office property located in Jeffersonville, IN. As part of this transaction, BSP acquired the property.

$10.6 Million

Hospitality

South Lake Tahoe, CA

BSP provided a $10.6 million floating-rate loan to finance the acquisition, renovation and reposition of a 96-key, limited-service boutique hotel located in South Lake Tahoe, CA.

$5.1 Million

Retail

Newport News, VA

BSP provided a small-balance fixed-rate loan of $5.1 million to finance the acquisition of a 14K SF NNN, IG single-tenant located in Newport News, VA.